Go back to Blog

Jennifer Edidiong

Marketing

8 min read

Share to

Dojah Product Update Roundup – August 2025

Identity verification and fraud prevention are critical for every fintech, startup, or business handling payments, onboarding new users, or managing high-value transactions. But keeping fraud out while ensuring a smooth customer experience isn’t always easy.

At Dojah, we’re committed to helping you strike that balance: stronger compliance, less friction, and satisfied users. Over the past few months, our product team has been working on updates to make this possible.

In this post, I’ll walk you through the most recent improvements and show you how to use them to secure your platform while delivering a seamless user experience.

Latest Features & Improvements

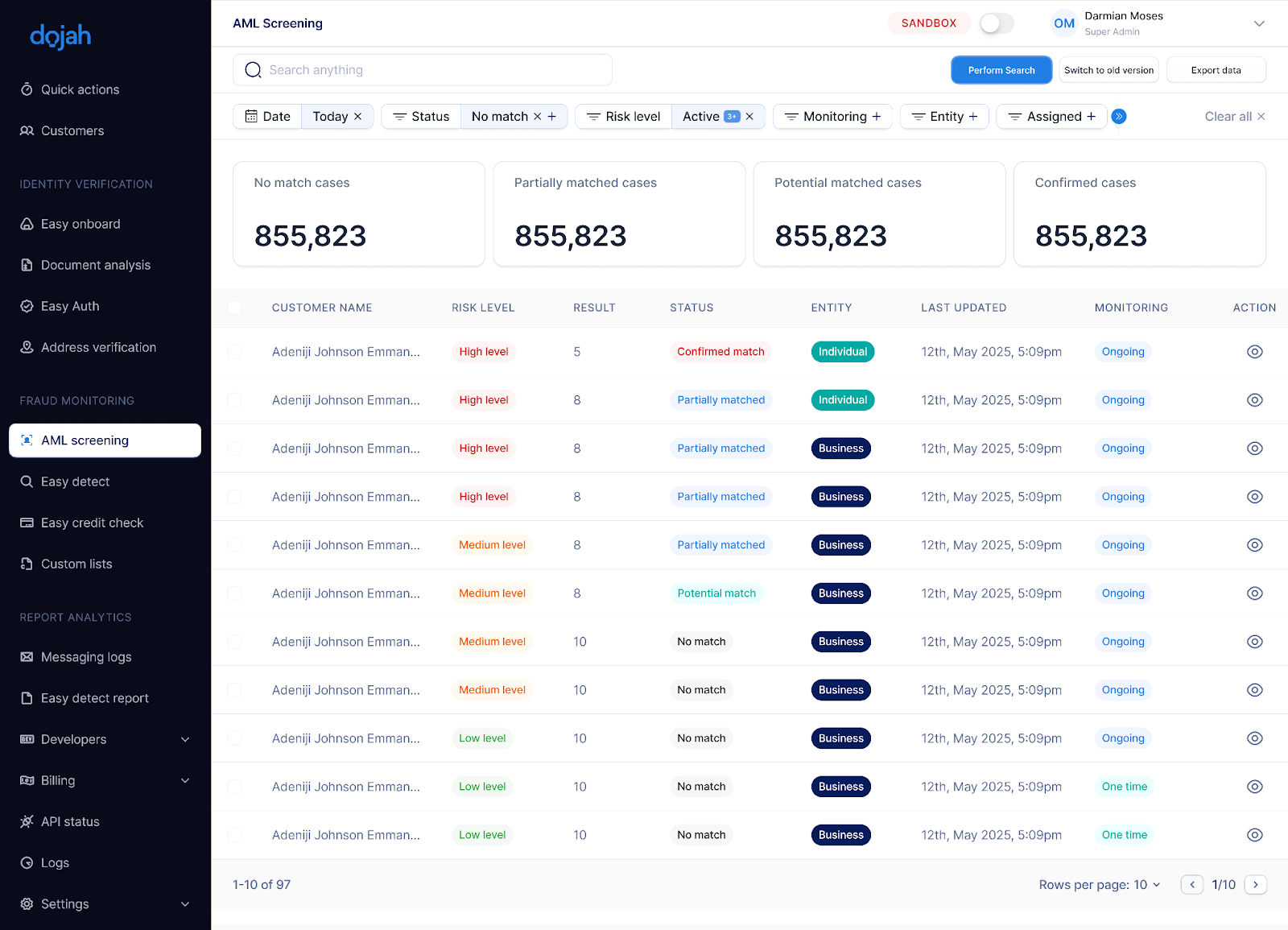

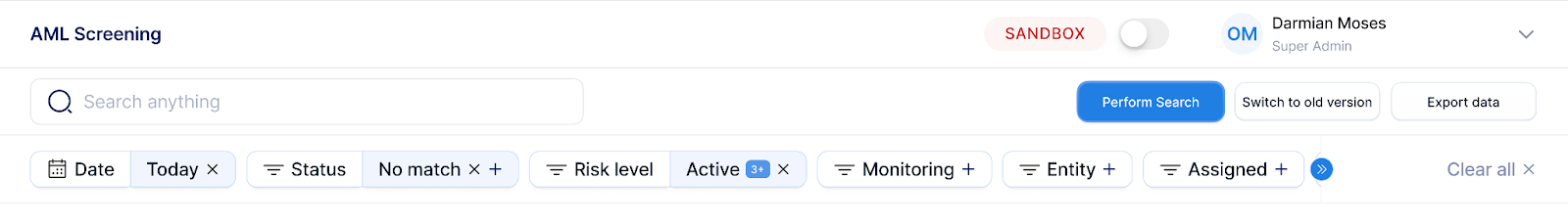

AML Screening Enhancements

Fraud detection and compliance can be complex and time-consuming. That’s why we enhanced our AML screening, transforming it from a basic watchlist search into a full AML case management system. With this update, you can now manage your entire compliance workflow in one place, making it easier to detect and prevent fraud.

How It Works

With the enhanced AML screening, you can:

- Perform detailed searches using multiple identifiers like first name, last name, middle name, year of birth, country, client ID, entity type, and categories such as sanctions, PEPs, or adverse media.

- View auto-generated search results as full cases, with multiple results linked to a single search.

- Assign cases to colleagues for further review, so your team can collaborate efficiently.

- Update case status with options like No Match, Potential Match, False Positive, or Confirmed Match (Suspicious).

- Assign and adjust risk levels (Low, Medium, High, Critical) with visual badges/icons, or let the system suggest risk automatically.

- Flag cases for ongoing monitoring when necessary.

- Log and view comments for better collaboration and knowledge sharing.

- Track all actions in a permanent audit trail, capturing status changes, assignments, risk updates, and comments.

- Download full case details in PDF format for reporting or audit purposes.

Batch upload remains supported, allowing multiple searches at once, making it faster to process large datasets.

Here’s What This Means for You:

- Before, you could only run a basic AML search. Now, your fraud or compliance manager can review full cases in one place, saving time and reducing manual work.

- You can assign cases to colleagues, so collaboration is smoother and everyone knows who is responsible for what.

- Automatic risk scoring and flexible updates mean you spend less time guessing risk levels and more time acting on cases that matter.

- Comments and audit trails let your team share insights and track every action, making onboarding new team members easier.

- Downloadable case reports give you ready-to-use PDFs for audits or internal reviews with no extra work needed.

Start using the enhanced AML screening today by navigating to your AML dashboard and performing a search. Assign cases to your team, update statuses, add comments, or download case reports to see the improvements in action.

If you’re already using Dojah, head to your AML dashboard to explore these updates.

Not using Dojah yet? Learn more about how our AML tools can support your compliance needs here.

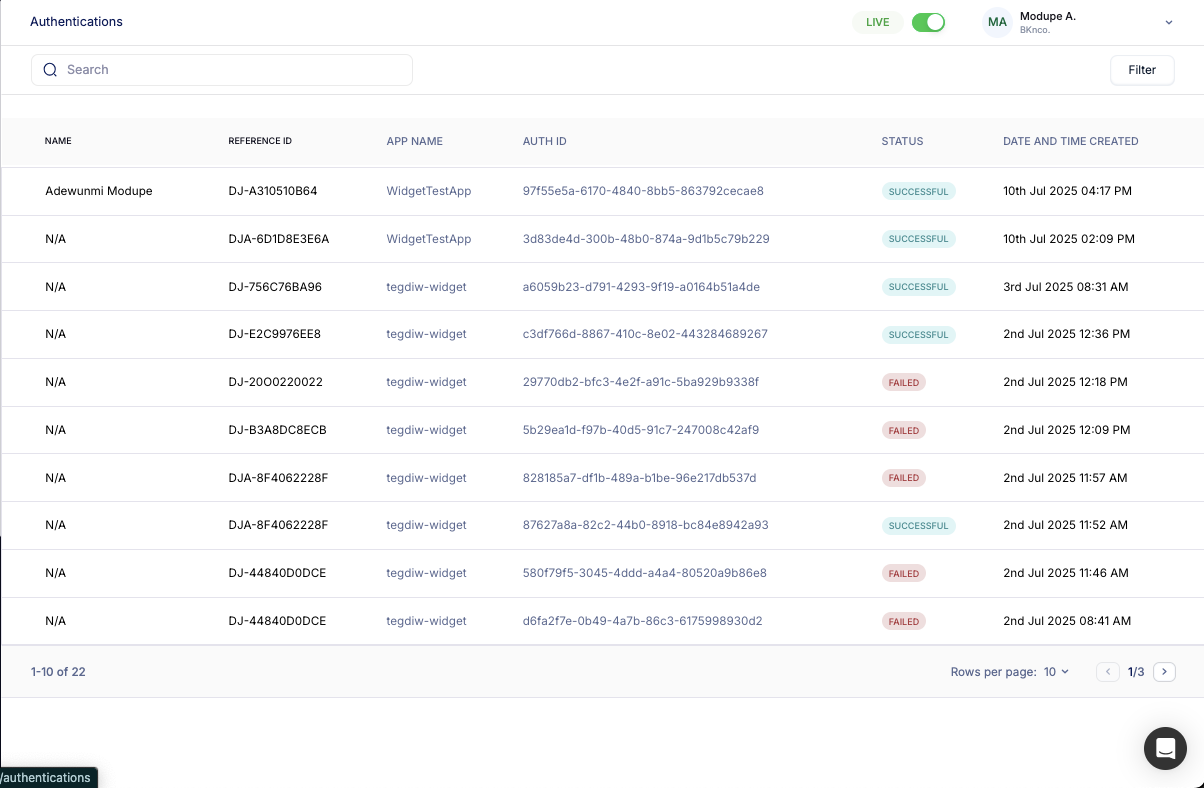

2. User App UI Updates

We rolled out significant design and usability upgrades to the User App,making it easier for you to find what you need and manage verifications faster. With these changes, navigating your dashboard is smoother, more user-friendly.

How It Works

- The interface has been refreshed with a modern look and feel, giving you a cleaner, more organized layout.

- Filtering options are now displayed in a transparent table instead of a pop-up, so you can see all available filters at a glance.

- User flows and UI elements have been improved, making it faster to access key features and complete tasks.

Here’s What This Means for You:

- You no longer have to dig through pop-ups to find the filters you need.

- Access key data and features more quickly with an intuitive layout.

- Spend less time navigating and more time focusing on your core tasks.

- Enjoy a smoother, cleaner visual experience that reduces friction while using the app.

Log in to your dashboard today to try the new filters and experience the refreshed flow.

3. Easy Authentication Launch

When handling large transactions or sensitive activities, you need to be sure customers are who they claim to be. But reconfirming identities often adds extra steps that slow things down. That’s why we launched Easy Authentication, a faster, more secure way to verify users without any extra KYC checks.

How It Works

- Easy Authentication integrates seamlessly into your onboarding or high-volume transaction flows.

- Users can reconfirm their identity with a simple selfie, eliminating the need to repeat the entire KYC process.

- The system automatically matches the selfie against previously submitted documents, such as passports or ID cards.

- Liveness checks ensure the person taking the selfie is genuine, adding an extra layer of security.

Here’s What This Means for You:

- Your users no longer have to repeat the full KYC process, reducing frustration and improving completion rates.

- Repetitive data entry on your platform is eliminated, saving time for your team.

- Transactions can proceed faster, improving overall user experience and retention.

- Security is maintained with automatic document matching and liveness verification.

With this update, you can keep your platform safe while saving time for you and your customers. Integrate EasyAuth into your flows today and let users confirm their identity with a simple selfie. Learn more here.

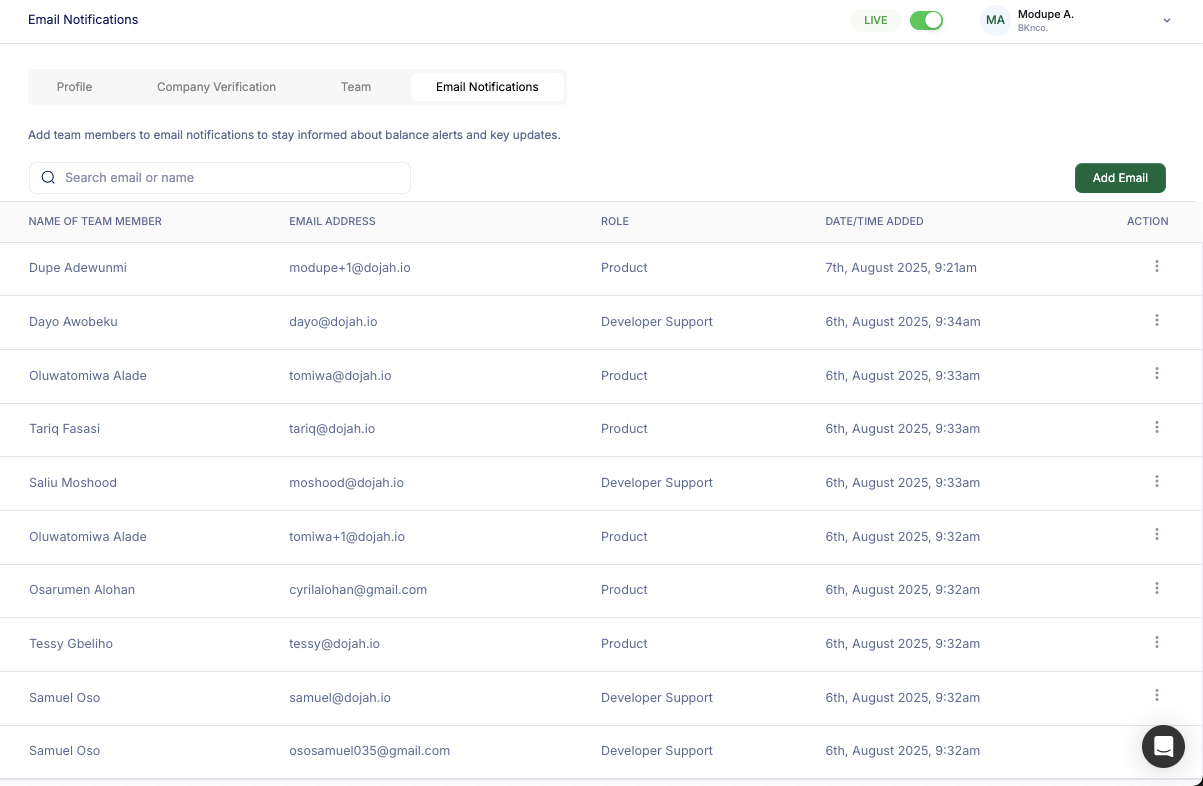

4. Email Notifications for Wallet Updates

Missed wallet alerts shouldn’t cost your business failed verifications or frustrated users. In the past, notifications went only to a single generic email (like [email protected]). This meant individual team members, those actually managing verifications, often didn’t see balance updates in time.

Now, with our new Email Notifications update, you can add multiple team members to receive wallet alerts. Everyone stays in the loop, and your verification process runs smoothly.

How It Works

- Add team members with their work emails (e.g., [email protected]) to receive wallet notifications.

- Get alerts for wallet top-ups, low balances, or when you reach your set threshold (e.g., at ₦100k if your balance is ₦500k).

- Ensure no one misses critical updates that keep your verification services running.

Here’s What This Means for You:

- Reduce failed verifications caused by unnoticed low balances.

- Keep your compliance or operations team fully informed at all times.

- Prevent customer frustration by avoiding unnecessary service interruptions.

- Gain more control and transparency over your wallet usage.

This update helps your team stay on top of wallet activity and prevent failed transactions. You can start using it today by adding team members to your notification list in your dashboard.

Learn more about how this feature works here.

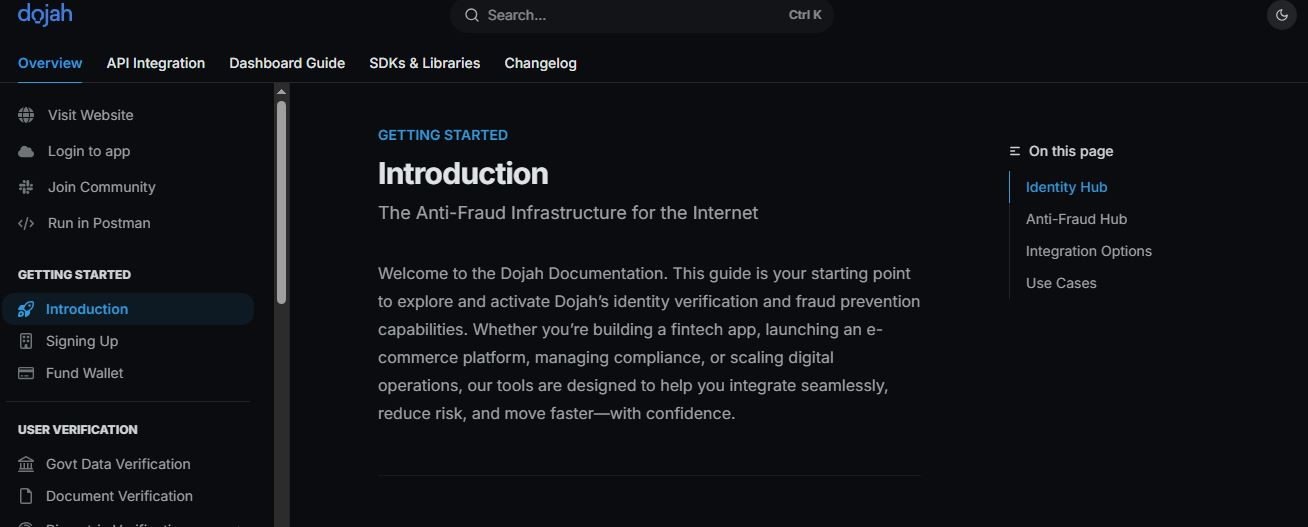

5. Revamped API Documentation

We know integrations can sometimes feel complex, especially when documentation isn’t clear or detailed enough. That’s why we’ve made our API documentation more robust, organized, and easier to understand.

Whether you’re a developer integrating Dojah for the first time or a product manager reviewing capabilities, our updated documentation helps you move faster with less back-and-forth.

What’s New

- Clearer explanations of endpoints and use cases.

- Better structure for easier navigation.

- More detailed request/response samples.

- Improved error handling guidance and examples.

Here’s What This Means for You:

- You can now integrate faster and smoothly, without running into unnecessary blockers.

- This update helps you spend less time trying to interpret technical details and more time building.

- Your new developers can onboard more easily, since everything is explained more clearly.

- You can feel more confident when testing and deploying Dojah APIs, knowing the guidance is clearer and more reliable.

Check out the new documentation here and see how much easier it is to integrate and explore Dojah’s capabilities. If you’re already building, this update will help you move faster. And if you’re new to Dojah, it’s the perfect place to get started.

What’s Coming Next?

We’re committed to making it easier for you to verify users and protect your business from fraud. In the coming months, you can expect more updates designed to make onboarding, compliance, and verification simpler.

If you have feedback on how we can improve your verification or compliance experience, we’d love to hear from you.

And if you’re interested in simplifying your KYC and fraud prevention process, then book a demo to see how Dojah works for you.

Start using Dojah for all your business needs